Deciding

To Sell

Select an

Agent & Price

Prepare

To Sell

Accepting

An Offer

Inspections

& Appraisals

Close Of

Escrow

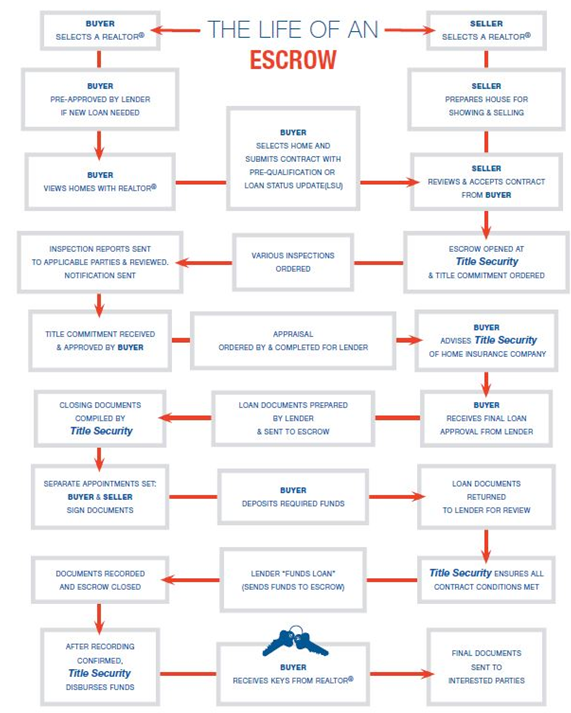

Inspections and Appraisals

Most buyers will have the property inspected by a licensed property inspector within the time frame that was agreed upon in the effective contract to purchase. Some buyers will have several different inspectors inspect the property, if they wish to obtain professional opinions from inspectors who specialize in a specific area (eg. roof, HVAC, structure). If the agreement is conditional upon financing, then the property will be appraised by a licensed appraiser to determine the value for the lending institution via third party. This is done so that the lending institution can confirm their investment in your property is accurate.

The Closing Agent.

Either a title company or an attorney will be selected as the closing agent, whose job is to examine and insure clear title to real estate. After researching the complete recorded history of your property, they will certify that 1) your title is free and clear of encumbrances (eg. mortgages, leases, or restrictions, liens) by the date of closing; and 2) all new encumbrances are duly included in the title.

Escrow

Contingencies.

A contingency is a condition that must be met before a contract becomes legally binding. Before completing his or her purchase of your property, the buyer goes over every aspect of the property, as provided for by purchase agreements and any applicable addendums. These include:

OUR COMMITMENT TO SELL YOUR HOME: SERVICE TO CLIENTS WHILE THE PROPERTY IS UNDER CONTRACT

- Call or e-mail as needed but not less than once a week.

- Call the other agent, the lender, the escrow officer as needed but not less than once a week.

- In compliance with the purchase contract, instruct the closing agent/escrow. to open and draw documents

- Monitor transaction for timely completion of all contingences including, but not limited to, deposits, inspections, and loan contingencies.

- Recommend service providers and coordinate any and all requested repairs.

- Monitor status of buyers’ loan and report to sellers..

- Follow progress of title transfer.

- Anticipate and assist in solving any special problems associated with the sale of the property.

- Coordinate any other transactions relating to the sale of this property.

- Coordinate closing logistics including final closing and appointments.

- Monitor buyers’ deposit of funds and signing of all final documents.

- Personally inform you when the property has closed/recorded.

- On moving day, transfer keys and garage door openers from you to buyers.

Follow up and advise on delivery of proceeds.